Wealth Formula: Unlocking Your Path Of Least Resistance

Jun 15, 2022

There is an unlimited amount of capital flowing around this planet as a result of our wealth creation. Great well-off creators has built their fortunes by channeling flow through themselves, rather than pursuing it.

We’ll go overflow and how the formula can generate our own wealth.

What is flow?

The different Wealth Dynamics profiles serve as a portal to a more productive state known as 'flow.' Flow is the path of least resistance, where you add the most value and accomplish the most.

A river can be thought of as a metaphor for Wealth. A basic principle is found inside it. Flow.

Considering the different paths in a wealth dynamic square system, when we are in our own personal flow, we generate the most wealth. Anyone who builds a river around this flow attracts the greatest wealth. Let's take a look at the wealth creation formula to create our own metaphorical flow in a river:

The Formula

Making money is not the goal of wealth creation. It's all about creating the flow. Every path to wealth is created from a simple equation. This wealth formula can be summarised as:

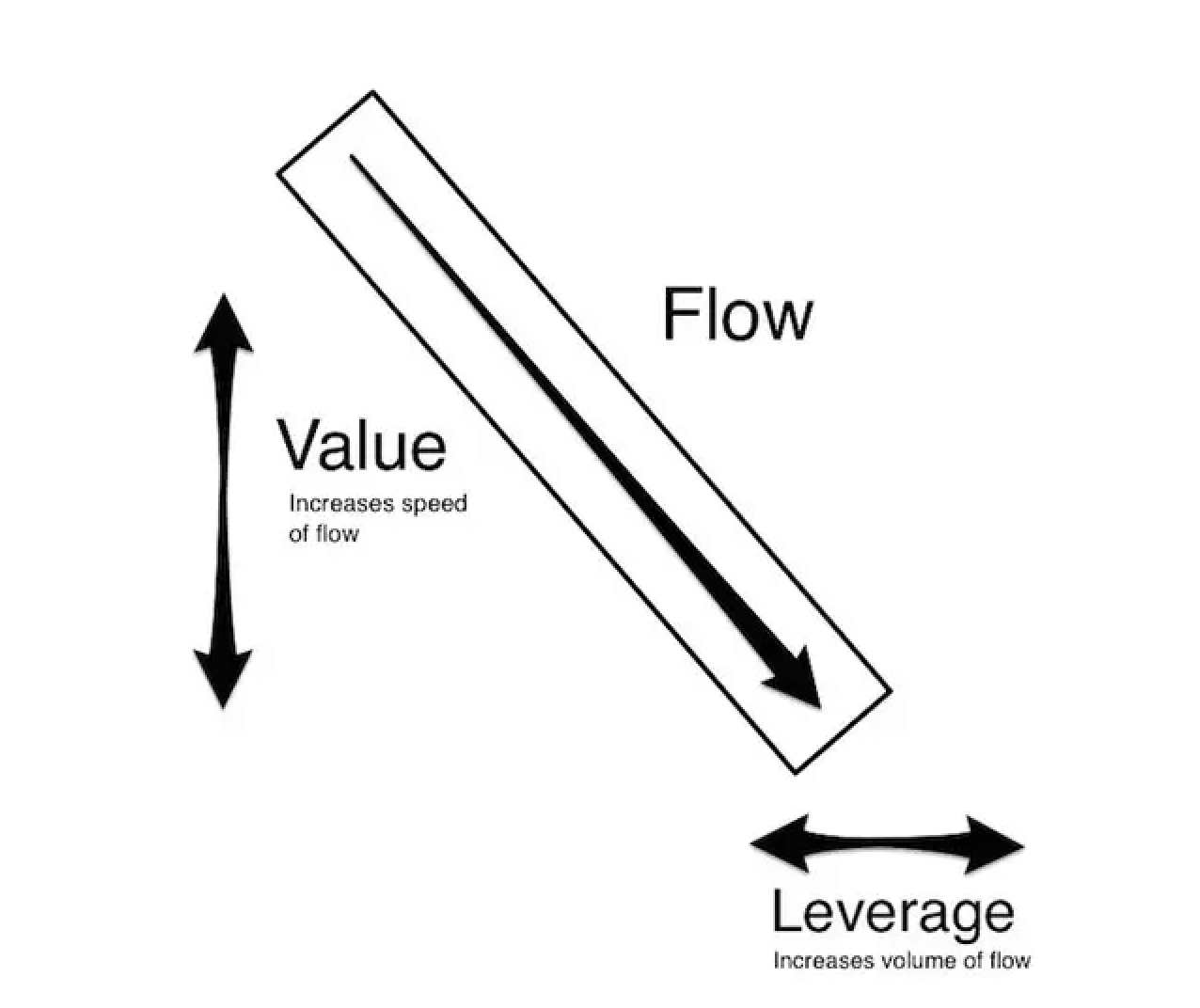

WEALTH = VALUE x LEVERAGE

In the same manner that water flows in a river, money follows the same principles. The river's height and width are the two variables that govern the water flow at any given stretch. Similarly, value and leverage are two related elements that make up wealth and will impact money flow. Here's how:

Value

Water will always flow in one direction, from high ground to low ground. The speed of water flow at any given time is determined by the height differential. The speed of water flow is doubled when the river's height is doubled.

Money will also flow where there is a value differential. It will always flow from high to a low value.

For example, if someone sells you an item for a given price. It means they don't value the item as much as the price you paid for it. This means you value the item more than the money you gave to it. If you both decided the item was worth double the price, then double the amount of value would have flown.

Value is created in two different ways. This is due to the natural orientation of your thinking brain:

- Intuitive thinking

- Some of us have a temperament for 'intuitive' thinking with high frequency.

- Through innovation, these people create value. Something new has value - it's bigger, faster, cheaper, smaller, better, and so on. A good example of an intuitive thinker would be Bill Gates, with his creative mind.

- Sensory thinking

- Some of us have a proclivity for 'sensory' thinking at low frequencies.

- These people add value by timing things correctly. Time is the most valuable commodity; They don't need to create something to create their wealth. An example of a sensory thinker would be Warren Buffet, with his analytical mind.

Leverage

Value is only one-half of the flow in the river. The width and depth of the river are known as leverage. Whatever the value, leverage dictates the volume of money flow. Even if the value is the highest, if there is no leverage, the volume of money flow will be little.

A good example of looking at how leverage is best utilized is by analyzing Bill gates. Gates didn't have the best software available but he was the best at leveraging it. While Steve jobs and the apple team were coming up with new innovative products in his software. Gates was pushing the expansion of the PC market as a means of distributing his software. In return, the entire PC industry developed by leveraging his products. He was then able to concentrate all of his efforts on developing his software products.

Once again leverage is used by wealth creators in two different ways. This is due to our action dynamic, which is how we automatically translate our thoughts into actions:

- Internal action dynamic

- Some people act best by using systems and numbers.

- Multiply value by being able to answer the question "How could this happen without me?"

- Multiply to leverage. This is done by creating a system that can function without them being directly involved. Once they have created that system they can walk away and let it generate the cash flow for them.

- External action dynamic

- These people depend more on people and communication to interpret and act.

- Leverage value by answering the question "How can this only happen with me?".

- Magnify to leverage. They create situations where something can only happen with them involved. The other party becomes dependent on these people. For example, a star actor is the only person who can play that character in the next movie.

Note: If you need help putting into place leverage and value for your business, try our Wealth Dynamics Coaching. We'll offer you insights into how to scale your business consciously.

Creating value and building leverage

There are so many industries to generate wealth. Whether it be through investing in the stock market, real estate or simply offering services in your chosen field.

Here are examples of how different personality profiles have used value and leverage to increase their net worth:

Buck Joffrey

Buck Joffrey has used his financial education by investing in the right areas at the right time. He has leveraged the value he has created by raising more capital to invest further.

Lionel Messi

Messi has made himself an indispensable player at Barcelona. He is regarded by many as the greatest player ever. Winning 7 Ballon d'Ors in the process. He uses this as leverage to negotiate better contracts as the team would lose so much talent if he left the club.

George Soros

By taking advantage of short-term volatility in markets George Soros has managed to become one of the most famous traders. He can use his knowledge to literally leverage capital while doing this on financial exchanges.